Ravi Dharamshi

Arvind Ananthanarayanan

Aniket Dharamshi

Megatrends are powerful, transformative forces that change the global economy, business, and society.

Megatrends are structural shifts that are longer term in nature and have irreversible consequences for the world around us. Although they evolve independently of the economic cycle, often along seemingly different paths, and timescales, they possess the capacity to redraw the investment and industrial landscape.

The awareness of megatrends in investment processes offer real insights that influence our investment decisions – from how we identify opportunities to where we look for them.

Anthropogenic Climate Alteration, The World’s greatest challenge

Human activity over the last two centuries has accelerated quality of living for vast swathes of population but has come with the cost of ecological impacts. Indeed, the present epoch is called the “Anthropocene” (Era dominated by humans) for this reason. Current prediction suggests that the human predilection for energy use would lead to an average global temperature increase by over 5oC unless suitable steps are taken to prevent the same. Needless to say, such a quick temperature rise is unprecedented in the planet’s history, and threatens with barely understood consequences.

As the planet nears the climatic tipping point, steps are being taken globally to urgently address climate change. At the forefront of these efforts is the energy sector, itself responsible for over 75% of greenhouse gas emissions. To address climate change, a complete transformation in our relationship with energy is underway encompassing production, transport and utilization supported by legislation.

The path to net‐zero emissions is narrow: staying on it requires immediate and massive deployment of all available clean and efficient energy technologies.

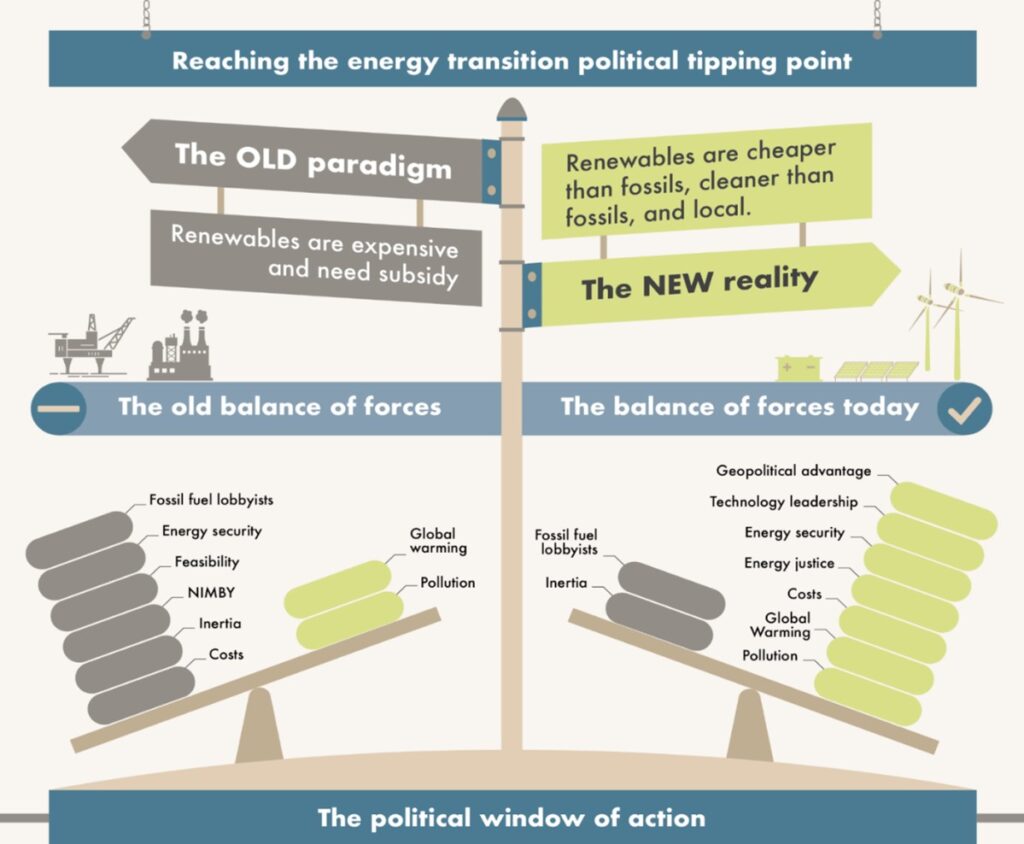

Cause for optimism

In this crisis rests a cornucopia of opportunity. Never have investments, policy, innovation, and public awareness been so aligned. History is replete with examples of energy policy being pulled hither tither by often contradictory external “impact” factors, with judicious choice between cost and convenience; national security or environmental protection; availability or inclusivity to name a few. The advancement of technology since the last false start of the energy transition paradigm post the 1970s now aligns previously contradictory forces. The new technologies of the energy paradigm point in a single direction toward a sustainable energy future. Humanity embarking on this journey will open the opportunity of the decade.

Call to action

All stakeholders are committed to reduce emissions: 131 countries covering 90% of global GDP have introduced net-zero targets, 46 countries have implemented or announced carbon dioxide emissions pricing or trading schemes. Globally, 40 national hydrogen strategies have been announced as countries set pathways to tap into hydrogen’s potential to decarbonize, ensure energy security, and spur sustainable economic growth from stranded energy resources. Stakeholders from governments to industries to consumers themselves increasingly recognize that hydrogen is needed to achieve net-zero emissions. Fifty countries and regions are planning to ban ICE cars.

- The share of emissions covered by tax has increased fourfold in a decade to nearly a quarter. (Carbon Tax)

- With passage of the IRA, the US triples federal spending on climate —getting in the game with China, the EU, and India with a vision on gaining leadership

- Three new bills that invest throughout the technology adoption S-curve, encourage innovation, back multiple technological solutions, and embrace risk:

- The CHIPS and science act 2022

- The infrastructure investment and Jobs act 2021

- The Inflation reduction act 2022

Building momentum

The Energy Trilemma – cost, security, and climate: once at odds, now stand fully aligned with renewable electricity being the cheapest source of electricity in over 90% of the world. Further, 90% of people live in countries with abundant renewable energy. As an icing on the cake, renewables have an ecological footprint c.100 time lower than fossil fuels. Thus, the alignment of cost, convenience, and energy independence/security under the aegis of climate change mitigation is creating the opportunity of the decade. The transition has led to the creation of technologies which cannot be un-invented, vesting irreversibility in this megatrend.

Driver 1 – Economic Reason – Cost & Adoption

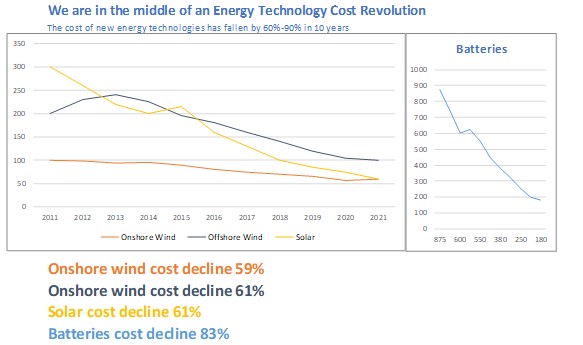

- The cost of new energy technologies has fallen by 60%–90% in 10 years

- Adoption of technologies is global

- Electricity just overtook oil as the world’s top energy carrier and is accelerating

- Electricity replacing coal in the Chinese industrial sector since 2013

- Solar, wind, batteries, and hydrogen all have been beneficiaries of aggressive learning rate curves. Further key renewable energy technologies enjoy similar learning curves.

- Fossil fuels do not have learning curves because technology improvements are offset by reserve depletion

- Renewables enjoy zero or near zero marginal cost unlike fossil fuels

- Learning curves, which are best predictors of future cost are extremely persistent.

- If we continue existing learning and growth rates, then by 2030 the world will enjoy $15 per MWh solar, $25 per MWh wind, $50 per kWh Li-ion batteries, and $1/kg green hydrogen.

Driver 2 – Selfish Reasons – Energy Independence/security

While politically motivated, the recent conflict in Ukraine brought home the importance of energy security. High prices of fossil fuels reduce fossil fuel demand and massively increase the competitiveness of renewable technologies.

Governments have an additional energy security and economic incentive to deploy renewables and increase efficiency. With every crisis there comes opportunities, a conflict in the Ukraine which choked the supply of natural resources, especially energy, will expedite an era of renewable resources.

According to Mckinsey, “The war in Ukraine has also dealt the effort to achieve net-zero greenhouse-gas emissions a powerful supply-side shock. Yet for public and private-sector leaders willing to take the necessary bold steps, the new logic of energy security and economics holds the promise of making this a turning point in seizing the opportunity to address the globe’s unfolding climate crisis.

Driver 3 – Altruistic reasons – Humanity benefits from the age of renewables

A significant benefit of the new energy paradigm is its inclusivity. Unshackled from geographical concentration, the availability of renewables will drive inclusivity. As such, renewable energy is the cheapest source of electricity for over 90% of the population, while the concept of concentration of economic rents is rendered obsolete as no one (or country) owns the sun.

Transition underway

- ICE sales are down by 20% since 2017.

- Fossil fuel power station capex is down 26% since 2015.

- Oil and gas upstream capex is down 41% since 2015.

- 60% of the world has already seen peak demand for fossil fuels.

- China is a quarter of fossil fuel demand. Once fossil fuel demand peaks in China, the global peak is indisputable. 80% of the world will then be in decline

- Solar and wind are now 5% of primary energy supply and will reach 15% before the turn of the decade.

We have all the technology we need

- A new cluster of technologies can replace the entire fossil fuel system

- Energy efficiency is improving all the time thanks to better design, machines, electrification, and digitization

- The primary renewable energy sources are solar and wind

- The key carriers are electricity, batteries, and hydrogen

- The new prime movers include EV, heat pumps, ammonia powered ships and other non-fossil machinery

Clear, imminent, and desirable change

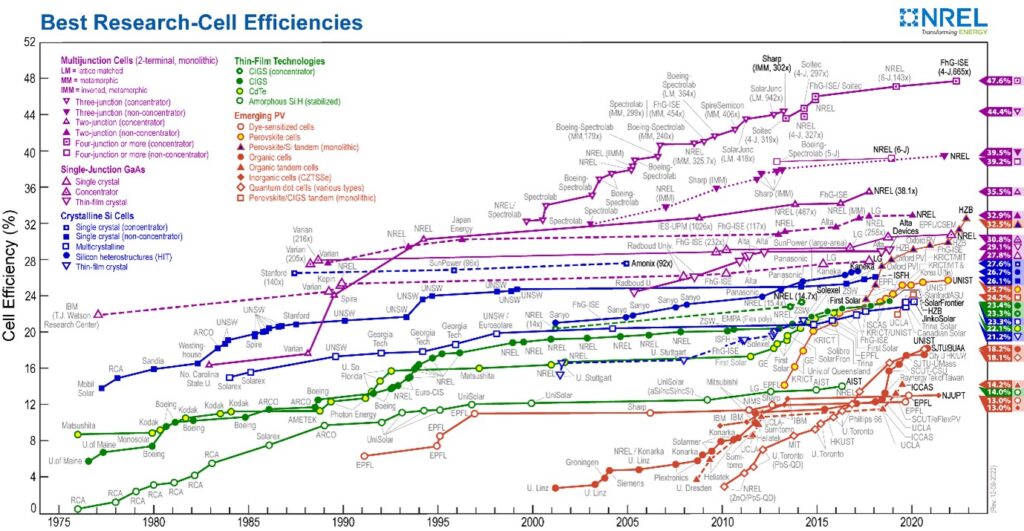

- Technology not Ideology – The energy transition is not primarily a debate about ideology or values. It is simply a profound technological shift. This shift has for example led to a dramatic increase in the efficiency of solar PV technology. Where early Si based solar cells in the 1980s struggled to exceed 5% cell efficiency, the same materials now exceed 15% efficiency and are closing rapidly on the theoretical limit of 22%. Novel technologies such as multi-junction devices can approach 45% efficiency but are presently too expensive to deploy widely.

- Market Forces are driving the transition duly supported by regulation

- Equitable – The IEA calculates that there are already more jobs in clean energy than in fossil fuels and these jobs will be localized as importers (80% of the world), spend the economic rents paid to petrostates locally

Peak Fossil Fuel

The change in demand is reflected in early peaking of the same for incumbents, while the engineering heavy nature of the business leads to a plateau. There can be brief hills on this plateau caused by external factors such as the pandemic or conflicts, which further lends impetus to the transition. These hills however are not a resumption of strength for the incumbent, but an Indian summer followed by sharp declines when the new technology moves to maturity up the S-curve. In 2019, fossil fuels were only 15% of the increase in energy supply. In the crash and recovery of 2020-21, solar and wind supply increased by 7 EJ, and other renewables by 1 EJ. Fossil fuel supply fell by 0.4 EJ. Solar and wind are now 5% of primary energy supply and growing at around 20% a year. Therefore, energy demand growth in 2022 would need to be more than 1% for fossil fuel demand to exceed its 2019 levels.

Risks

Fossil energy has been the prime mover of global industry for more than a century and this capital-intensive industry occupies more than a quarter of the global equity market capitalization. As peak fossil fuel demand occurs amid consumption slowdowns in China, this directly puts 25% of the world’s capital markets at risk. Additionally, the collateral damage is expected to spill into the lenders and bond issuers associated with this sector.

Opportunity

Larry Fink of Blackrock proclaimed “I believe the decarbonizing of the global economy is going to create the greatest investment opportunity of our lifetime. It will also leave behind the companies that don’t adapt, regardless of what industry they are in. And just as some companies’ risk being left behind, so do cities and countries that don’t plan for the future.”

The challenge of transforming energy systems is also a huge opportunity for our economies, with the potential to create millions of new jobs and boost growth. Total annual energy investment to reach USD 5 trillion by 2030, adding an extra 0.4 percentage point a year to annual global GDP growth. Such broad-based pivots are milestones in human history, and correspondingly rare. Identifying and investing in the companies that will lead this charge will no doubt be enriching and rewarding. The sun is shining bright, and the light is shining through.